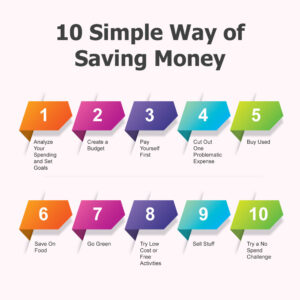

Money saving tips for families : Ee top 10 money-saving tips family members ki financial stability maintain cheyyadaniki help chestayi. Budget ni create chesi, expenses ni track chesi, monthly savings automate cheyyandi. Meal planning, home cooking tho dining out costs ni taggipothundi. Coupons, discounts use chesi, grocery shopping lo savings chesthe, utility bills ni reduce cheyyandi. Impulse purchases ni avoid cheyyandi, subscriptions ni review chesi, only necessary ones ni retain cheyyandi. Public transportation, bulk buying, and financial literacy ni teach chesi, overall budget ni manage cheyyandi. Ee tips follow chesi, family expenses ni easily control cheyyachu.

1. Create a Budget

Description: Budget ni create chesi, income and expenses ni track cheyyandi. E process valla, money ekkada veltundi, dani gurinchi clarity ostundi. Manam chese spending ni monitor chesi, unnecessary expenses ni cut chesukovachu. Budget lo essential items and savings ki place cheyyandi. Monthly budget plan chesi, adi follow avvadam vallane financial stability maintain cheyyachu. Budget ni regular ga update chesi, changes ni adjust cheyyandi, anduke monthly income and expenses track cheyyadam important.

2. Plan Meals and Cook at Home

Description: Weekly meal plan prepare chesi, grocery list ready chesi, cook at home anedi chaala cost-effective. Dining out chese cost ki substitute ga, cooking at home choosukovachu. E way lo, menu ni plan chesi, groceries ni list cheyyadam vallane wastage tagguthundi. Home cooking tho, nutritional value kuda maintain avuthundi, and budget ni easy ga manage cheyyachu. Regular ga meals plan chesi, grocery shopping chesi, dining expenses ni save cheyyandi.

3. Use Coupons and Discounts

Description: Coupons, discount codes, and store promotions ni utilize chesi, groceries and other essentials ni save cheyyandi. Shop chesetappudu, coupons ni check chesi, discount codes apply cheyyandi. Ivi chala savings create cheyyachu, especially regular items purchase chesetappudu. Stores lo offers and promotions ni observe chesi, shopping chesetappudu plan chesi, savings ni maximize cheyyandi. Discounts and offers ni regular ga follow avvadam vallane, overall family budget lo savings jarugutundi.

4. Reduce Utility Bills

Description: Utility bills ni tagginchali anukunte, energy-saving practices implement cheyyandi. Energy-efficient appliances vaadandi, lights and appliances ni use chese appudu matrame on cheyyandi. Thermostat settings ni adjust chesi, heating and cooling costs ni save cheyyachu. Ivi easy ga money save chesetayi, and environment friendly kuda. Regular ga utility bills ni review chesi, energy consumption ni optimize cheyyandi. Ee practices tho monthly bills lo chala reduction jarugutundi.

5. Limit Impulse Purchases

Description: Impulse purchases ni limit cheyyali anukunte, shopping list prepare chesi, adhe list follow avvandi. Online shopping temptations ni avoid cheyyandi, anduke planned shopping chesi, budget ki match chese items matrame buy cheyyandi. Impulse buys chala unnecessary expenses create chestayi, so list chesi, budget plan ni follow avvandi. Shopping chesetappudu, only required items ni purchase cheyyandi, financial goals ni achieve cheyyachu.

6. Automate Savings

Description: Savings ni automate cheyadam vallane, consistent ga monthly savings jarugutayi. Automatic transfers ni savings account ki setup chesi, every month fixed amount transfer cheyyandi. Ithi regular ga savings ni ensure chestundi, and manual effort pettuvalsi ledu. Ee method valla, savings account lo steady growth chesi, unexpected expenses ki ready avvachu. Automated savings plan ni setup chesi, monthly budget lo fixed amount allocate chesi, future financial stability ni build cheyyandi. Regular deposits tho savings goal ni easy ga achieve cheyyachu.

7. Review and Adjust Subscriptions

Description: Subscriptions ni review chesi, unused or unnecessary services ni cancel cheyyandi. Streaming services, magazine subscriptions, gym memberships and other recurring charges ni evaluate chesi, only essential subscriptions ni retain cheyyandi. Ee process valla, monthly expenses lo significant savings jarugutundi. Unused subscriptions ni cancel cheyyadam vallane, budget ni adjust chesi, savings ni increase cheyyachu. Regular ga subscriptions ni check chesi, value for money services matrame continue cheyyandi, unnecessary financial burden taggundi.

8. Use Public Transportation

Description: Gas and vehicle maintenance costs ni reduce cheyali anukunte, public transportation, carpooling, or biking ni opt cheyyandi. Public transport use chesi, fuel expenses and vehicle upkeep costs ni save cheyyachu. Carpooling chesi, multiple people travel cheyyandi, fuel and parking costs ni share cheyyandi. Biking chesi, health benefits to patu, transportation costs ni kuda reduce cheyyachu. Ee options ni regular ga follow avvadam vallane, family budget lo savings create cheyyachu.

9. Buy in Bulk

Description: Non-perishable items ni bulk lo purchase chesi, lower prices ni take advantage cheyyandi. Bulk buying vallane, grocery shopping trips frequency taggipothundi and cost savings jarugutundi. Basic items like grains, canned goods, and household supplies bulk lo teeskondi. Ee method valla, unit price reduce avuthundi, and large quantities ni store chesukovachu. Bulk buying tho overall cost effective ga, financial planning ni improve cheyyachu.

10. Teach Financial Literacy

Description: Family members ki budgeting, saving, and smart spending gurinchi educate cheyyandi. Financial literacy ni teach chesi, good financial habits develop cheyyandi. Budgeting basics, savings importance, and spending discipline ni explain cheyyandi. Financial planning gurinchi knowledge create chesi, informed decisions teeskoni, future financial stability build cheyyachu. Regular discussions and financial education valla, family members ki financial goals achieve cheyyadam easy avuthundi, and overall financial health improve avuthundi.

Money saving tips for families 2024