Introduction: How to invest in stocks ante chala mandi ki interest untundi, kani ela start cheyalo, enni types of stocks, risk ela undi – chala doubts untayi. Ippudu mana andariki digital access undi kabatti, stock market lo invest cheyadam chala easy. E article lo mee kosam stock market basics, invest chese steps anni easy ga explain chestanu. So, inka late cheyakkunda, let’s start!

1. Stock Market ante Emiti?

Stock market ante oka platform, ikkada companies thana stocks (ante shares) ni public ki sell chestayi. E shares konna prathi okkaru a company lo shareholder avutharu, ante a company growth ki manam kuda participate chestham. Stock prices vary ayyevi, based on company performance, market demand, and economy changes.

Example: Ratan Tata company growth chesindi ante, a company stocks value baga peruthayi. Mana daggara a stocks unte, mana investment kuda peruguddi annatu.

2. Stocks Types Gurinchi Telusukondi

Stock market lo investment start chese mundu, stocks types emuntayi anedi gurthu pettukovali. Mainly two types unayi:

Equity Shares (Common Stocks): General ga andaru konnedi equity shares. Ikkada manaki voting rights unayi, and company growth tho patu manam kuda profit cheskuntam.

Preference Shares: Ikkada dividends manaki regular ga vastayi, kani voting rights undavu. Risk konchem takkuva undi.

Tip: Beginners ki equity shares preferable untayi, ekkuva growth potential undi.

3. Demat and Trading Account Open Cheyandi

Stocks konadaniki, sell cheyadaniki Demat account and trading account kavali. Ee accounts open cheyadam chala easy – brokerage firms like Zerodha, Upstox, ICICI Direct lanti platforms lo online 10–15 minutes lo open cheyocchu.

Tip: Valid PAN card, Aadhaar, bank account undali; KYC verification complete chesukondi.

4. Stock Market Basics Ardham Chesukondi

Market basics gurinchi telsukokunda invest chesthe risk ekkuva untundi. Simple ga stock market basics telusukondi:

NSE & BSE (National Stock Exchange & Bombay Stock Exchange): Ee rendu major stock exchanges. Prathi company stocks ee exchanges lo trade avutayi.

Sensex & Nifty: Ee renditini market indices antaru. Sensex lo 30 companies, Nifty lo 50 companies performance ni track chestayi. Ee indices naikite market growth, kinda padite market loss ani artham.

Tip: Stocks ni select chese mundu, company background and financials baga chudandi.

5. Research Chesi, Strategy Prepare Cheyandi

Invest cheyyali ante random ga stocks konakandi. Basic research chesi, konni strategies prepare cheyandi:

Long-Term Investment: Stocks konni years hold chesi, value peragadam wait cheyyadam.

Short-Term Investment: Quick gains kosam short period lo stocks buy, sell cheyadam.

Tip: Long-term lo profits ekkuva vastayi, risk kuda thakkuva undi.

6. Diversification ki Importance Ivvandi

Prathi paisa oka stock lo pettakunda, diversification cheskondi. Ante, different sectors lo stocks konadam. Ila cheste, oka stock loss lo unna, migata stocks manaki balance chestayi.

Example: IT sector lo oka stock, pharma sector lo oka stock konandi. Ila diversify cheste risk thaggi, profit chances perutayi.

Tip: Minimum 5–10 different stocks lo investment cheyandi.

7. Market Timings & Investment Discipline

Market timings baga gurthu pettukondi. Indian stock market 9:15 AM nundi 3:30 PM varaku open untundi, Monday nundi Friday varaku. Time ni batti trading, investment cheyadam kuda manaki help chestundi.

Tip: Market open-close timings gurinchi idea undali, and e timings lo sharp ga trading decisions teesukondi.

Tip: Rojuki stocks check cheyyadam aapeesi, discipline maintain cheyandi – unnecessary buying/selling cheyakunda patience maintain cheyadam important.

8. Risk ni Baga Understand Cheyandi

Stock market lo risk undi – loss kuda vastundi, profit kuda. Kabatti, emotional decisions teesukokunda, patience and strategy maintain chesukondi. Miru initial ga invest chese mundu risk appetite evaluate cheskondi, ante entha loss bear cheyagalataro fix cheskondi.

Tip: Beginners kosam, small amount tho start cheyandi. For example, Rs. 5,000–10,000 lo start cheyadam baga safe.

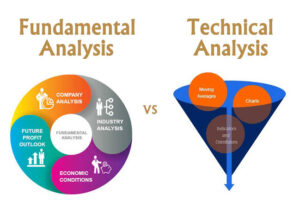

9. Technical and Fundamental Analysis Basics

Invest cheyadam lo technical and fundamental analysis ki importance undi.

Technical Analysis: Charts, patterns batti stock movement predict cheyadam.

Fundamental Analysis: Company financials (like revenue, profits, etc.) chusi stock potential evaluate cheyadam.

Tip: YouTube, online courses lo free ga technical analysis and fundamental analysis basics nerchukondi.

10. Mutual Funds kuda Consider Cheyandi

Direct ga stocks konadam koncham tough anipisthe, mutual funds lo invest cheyadam kuda option. Mutual funds lo professional fund managers manage chestharu kabatti, beginners ki easy ga returns vastayi.

Tip: SIP (Systematic Investment Plan) lo start cheyandi – monthly chinna chinna amounts tho investment cheyadam.

11. Start Small, Experience Ni Build Cheyandi

Starting lo chinna amounts tho experience techukondi, ala stock market dynamics ardham avutayi. Stocks movement baga follow cheyandi, prathi stock elanti situations lo react avutundo analyze cheyandi.

Tip: Initial ga losses unna worry avvakandi, learning curve lo part anukondi.

Tip: Apps like Moneycontrol, Groww, Yahoo Finance use chesi market trends follow cheyandi.

12. Stop Loss ni Fix Cheyadam Marichipokandi

Market lo fluctuations untayi, kabatti oka stock ki stop loss fix cheyadam important. Ante, stock certain price ki padite, automatic ga sell ayye option petti, loss ni control cheyachu.

Tip: Beginners ki 5–10% stop loss range baga work out avuthundi.

Tip: Emotional decisions avoid cheyadam ki stop loss chala help chestundi.

13. Investment Goals Fix Cheyandi

Mee goals clear ga undali – entha period lo entha return expect chesthunnaro fix cheskondi. Ila cheste, investment ki clear direction untundi.

Example: Retirement ki money save cheyyali anukunte, long-term stocks konandi. Short-term ga oka small goal ki invest chesthe, fast returns ichche stocks chudandi.

Tip: Goals fix cheyadam tho, unnecessary ga stocks buy/sell cheyakunda patience develop avutundi.

14. Continuous Learning tho Market Follow Cheyandi

Stock market lo updates vastuntayi, trends marchutayi – learning continuous ga undali. Market news, financial news, economic events anni follow cheyandi.

Tip: Apps like Economic Times, NDTV Profit, Business Standard use chesi, daily ga updates follow cheyandi.

Tip: YouTube lo financial experts, market analysts videos chusi, market insights telsukondi.

Final View:

Stock market lo invest cheyyadam oka journey laga chudandi, time and patience tho experience build avuthundi. Ippude start chesthe, initial ga konni mistakes ayye chance untundi – kani manchi discipline maintain cheste, stock market lo success vastundi. Ee tips follow chesi, stocks lo safe ga invest chesi, long-term wealth create cheyandi. Happy investing!

Email marketing best practices