2024 lo Best Mutual Funds Picks – E Investment Growth ki Manchi Options! investment mutual funds

investment mutual funds: Mutual funds ante, emi chinna amounts ni pedda pedda companies lo invest chesi growth ni enjoy cheyyachu. Emi stocks, bonds, or other securities lo mutual fund investments cheddam ante, adi oka pool funds laga work chestundi. 2024 lo best mutual funds gurinchi, emi benefits, risk factors, types mariyu ela invest cheyyalo clear ga chuddam.

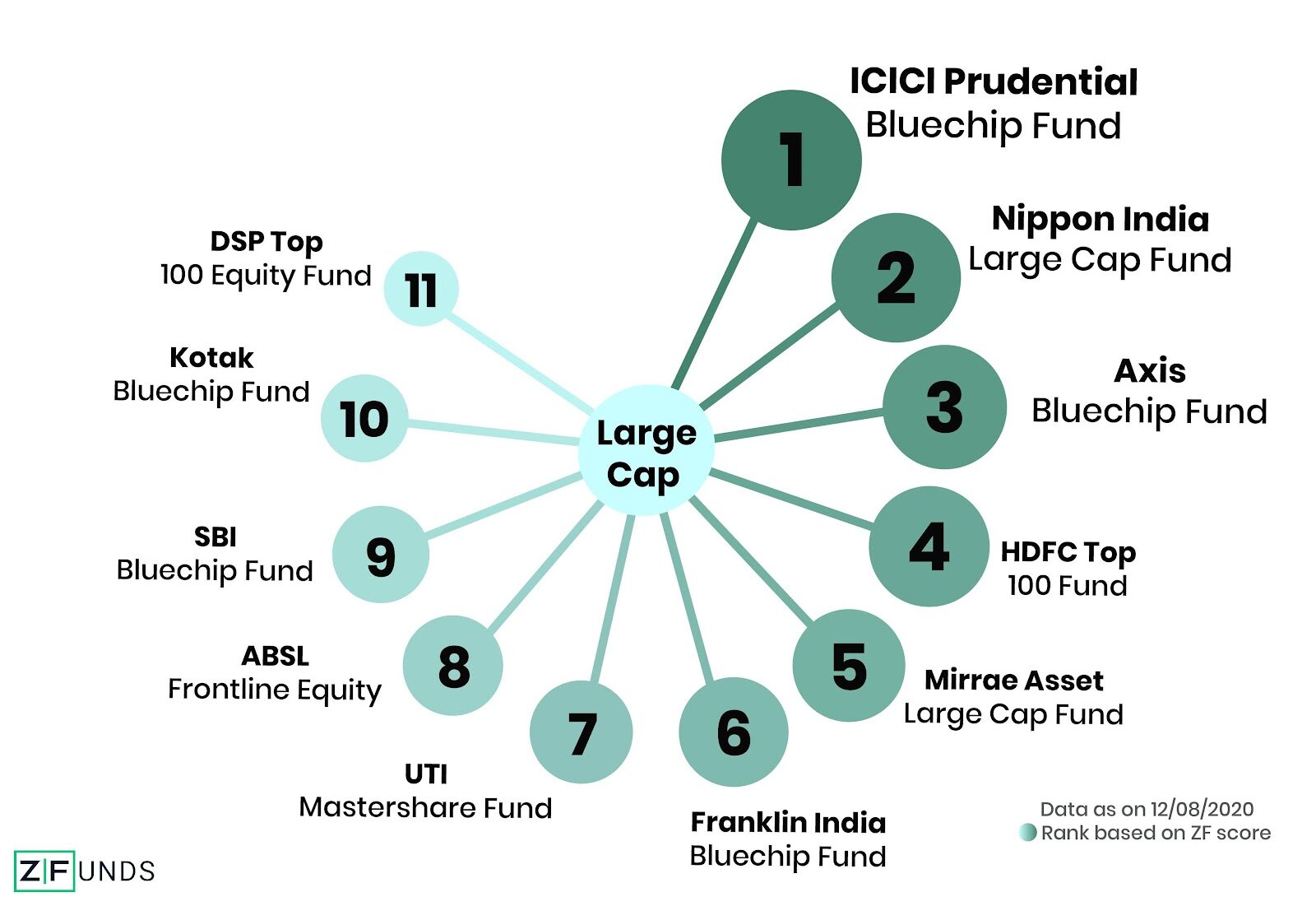

1. Large Cap Mutual Funds

Large Cap Mutual Funds valla, emi large and stable companies lo invest cheyyachu. Ee funds low risk tho stable returns ivvadam tho baga popular. Emi conservative investors ki best option ga consider cheyyachu.

Example Funds: SBI Bluechip Fund, ICICI Prudential Bluechip Fund

Benefits: Large companies lo invest cheyadam tho emi investment safe ga untundi.

Risk Factor: Low risk, kani emi growth limited ga untundi.

Te-English Suggestion: First-time investors ki ee type mutual funds oka manchi choice.

2. Mid Cap Mutual Funds

Mid Cap funds, moderate risk tho moderate returns kosam ideal avuthayi. Emi medium-sized companies lo invest cheyadam tho growth potential baga untundi. Risk thakkuva ga handle cheyyalani emi risk takers ki ee funds best choice.

Example Funds: HDFC Mid-Cap Opportunities Fund, Axis Mid-Cap Fund

Benefits: Growth manchi untundi, emi capital safe ga perugutundi.

Risk Factor: Moderate risk, stocks fluctuate ayina emi chinna impact padachu.

Pro Tip: Risk handle cheyyagalige investors ki oka exciting choice.

3. Small Cap Mutual Funds

Ee Small Cap mutual funds, small companies lo invest chesi high returns ni aim chestayi. Ee funds long-term investors ki, emi patience maintain chesi wait cheyyadam tho manchi returns ivvadam lo perfect choice.

Example Funds: Nippon India Small Cap Fund, HDFC Small Cap Fund

Benefits: High returns ki potential, small companies growth potential baga untundi.

Risk Factor: High risk, emi stocks fluctuate avvachu.

Suggestion: Emi long-term goals ki investment cheyyadam ki ready aina vallu consider cheyyachu.

4. ELSS Funds (Equity Linked Savings Scheme)

Ee funds emi tax saving kosam mutual funds ki chalaa popular options la unnayi. ELSS funds, tax benefits tho emi capital ni grow cheyyadaniki best options avuthayi. Emi tax benefits ivvadam tho salaried people ki baga helpful.

Example Funds: Axis Long Term Equity Fund, Mirae Asset Tax Saver Fund

Benefits: Tax deductions, emi wealth creation ki manchi avakasham.

Risk Factor: Equity exposure tho emi risk moderate ga untundi.

Te-English Suggestion: Tax saving ki plan chesthunnara ante, ELSS perfect fit avuthundi!

5. Index Funds

Ee funds market index follow chesi returns ivvadam tho simple ga, less management fees tho emi baga safe investments la untayi. Emi passive investing ki eppudu busy unna vallu ki ee funds best.

Example Funds: HDFC Index Fund – Nifty 50 Plan, ICICI Prudential Nifty Index Fund

Benefits: Market ki follow avvadam tho low risk, emi cost-effective.

Risk Factor: Low risk, market ni directly follow chesadi.

Pro Tip: Busy people ki emi time allocate cheyadaniki emi simple investment option ga consider cheyyachu.

6. Debt Mutual Funds

Debt funds ante emi low-risk, fixed-income funds laga untayi. Emi bonds, government securities, fixed income lo invest chesayi. Emi capital safe ga undali ante debt funds oka baga safe option avuthayi.

Example Funds: SBI Short Term Debt Fund, HDFC Corporate Bond Fund

Benefits: Stable returns, emi capital secure ga untundi.

Risk Factor: Minimal risk, emi returns limited ga untayi.

Suggestion: Emi safety priority unna conservative investors ki debt funds ideal choice.

7. Hybrid Mutual Funds

Hybrid funds, emi equity and debt lo invest chesi balanced returns ni ivvadam kosam design chesayi. Ee funds, emi high risk handle cheyyadam tho emi growth expect chesina vallu ki oka perfect option.

Example Funds: HDFC Hybrid Equity Fund, ICICI Prudential Equity & Debt Fund

Benefits: Balanced portfolio tho emi risk limited, returns stable ga untayi.

Risk Factor: Moderate risk, equity exposure tho emi returns stable.

Pro Tip: Emi balanced returns kosam simple ga equity mariyu debt exposure kavali ante hybrid funds perfect.

Mutual Funds Choose Cheyyadaniki Emi Tips

Goals Define Cheyyandi: Emi long-term investment or short-term goals ni define chesi emi best mutual fund ni choose cheyyachu.

Risk Tolerance Check Cheyyandi: Emi risk tolerance ni match chesi high, moderate, or low risk funds choose cheyyandi.

Expense Ratio Consider Cheyyandi: Emi expense ratio kuda check chesi, emi returns meedha impact avvadam avoid cheyyachu.

Performance Track Cheyyandi: Emi mutual fund performance past lo ela undho kuda track cheyyandi.

Professional Advice Tiskondi: Emi doubt unna advisors tho consult chesi emi best fund select cheyyachu.

Emi Goal Ki Best Mutual Fund Ni Ela Select Cheyyali

Retirement Goals: Emi long-term, safe retirement goals unte Large Cap and Hybrid Funds oka safe option.

Tax Saving Goals: Emi salary tax deductions kosam ELSS funds select cheyandi, emi tax save cheyyadam ki help chestayi.

High Growth Goals: Emi aggressive ga grow avvadam kavali ante, Small Cap or Mid Cap funds best options.

Mutual Funds Invest Cheyyadaniki E Benefits

Diversification: Emi chinna amounts lo multiple securities lo invest chesi emi risk minimize cheyyachu.

Professional Management: Emi funds professional fund managers handle cheyyadam tho emi return ki scope ekkuva untadi.

Flexible Options: Emi SIP tho chinna chinna amounts invest chesi emi fund ni grow cheyyachu.

Tax Benefits: Emi ELSS funds tax saving benefits tho emi tax deductions ivvadam tho manchi return dorukutundi.

Mutual Funds Invest Cheyyadaniki Emi Process

Online Registration: Emi fund company website lo emi KYC complete chesi register avvandi.

Select Fund Type: Emi goal ki match ayye mutual fund ni select cheyyandi, emi goal ki perfect fit chudandi.

SIP Setup Cheyyandi: Emi fixed monthly SIP tho invest chesi emi funds ni systematic ga grow cheyyachu.

Monitor Cheyyandi: Emi investment ni regular ga monitor chesi emi growth potential ni assess cheyyachu.

my view: 2024 lo Growth ni Chase Cheyyadam lo Mutual Funds Use Cheyyandi!

Ee mutual funds investment options emi 2024 lo oka successful portfolio ni create cheyyadaniki oka chala baga helpful avuthayi. Emi risk tolerance, goals ni base chesi best mutual funds choose cheyyandi. EMI high return expect chesi growth kavali ante small-cap or mid-cap funds ki plan cheyyachu, emi safety priority unte large-cap or debt funds oka baga use avuthayi. Emi investment ni emi time tho patience maintain chesi, successful returns enjoy cheyandi!